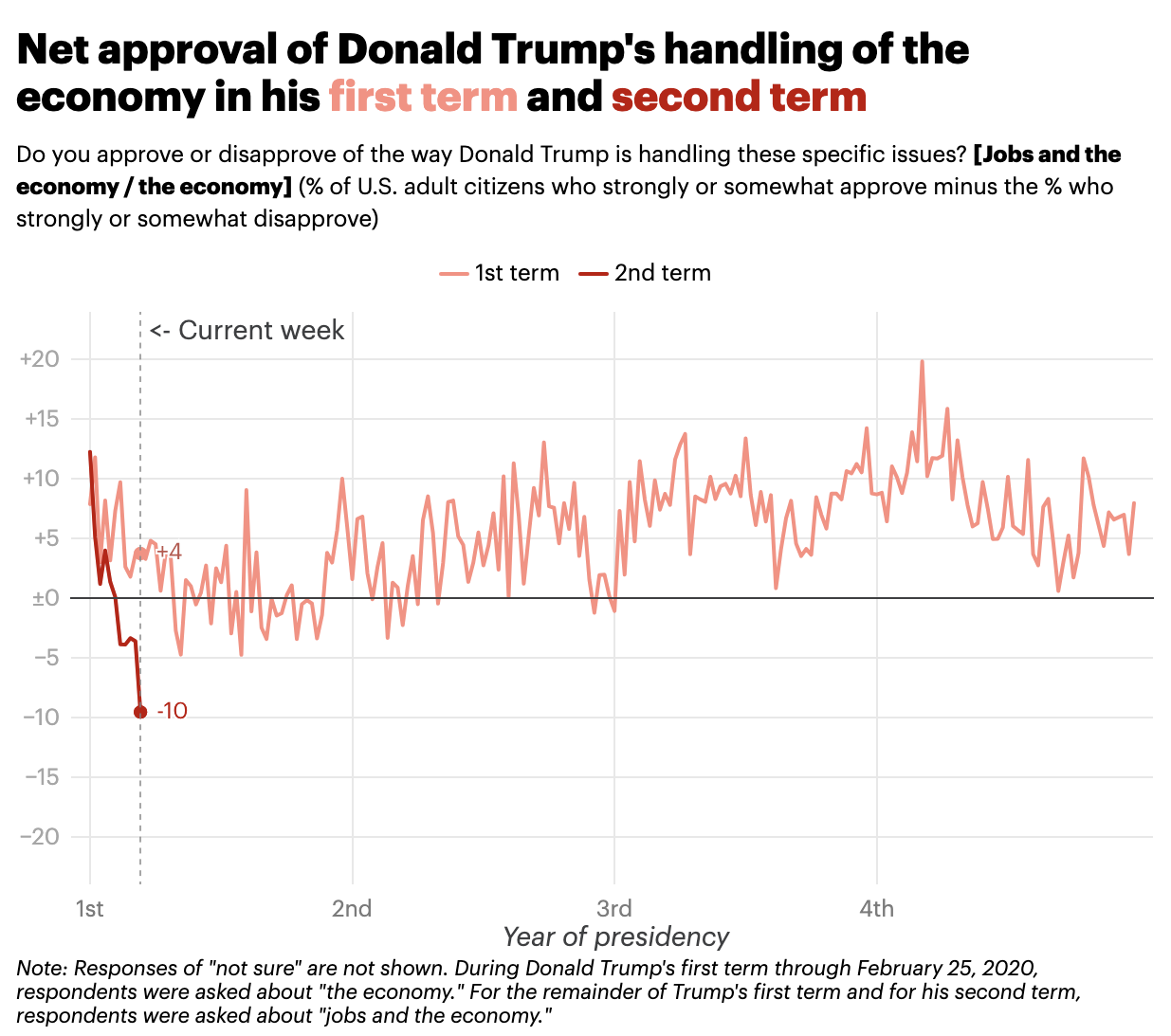

The Economist / YouGov | January 28, 2017 - April 8, 2025

The Economist / YouGov | January 28, 2017 - April 8, 2025

Donald Trump just declared war on the global economy—and the first casualty will be the American middle class.

In a single executive order, he imposed indiscriminate tariffs of 10% to 60% on virtually every imported product: phones, food, cars, clothing. If you didn't grow it, sew it, or build it yourself, it just got more expensive. This wasn't targeted. This wasn't strategic. It was the broadest, most reckless act of economic aggression by a U.S. president since the Great Depression.

And then, within days, he reversed course—except he didn't.

Facing market panic and internal chaos, Trump abruptly paused most of his “reciprocal” import duties for 90 days, but left in place his universal 10% tariffs—and simultaneously escalated the effective tariff rate on China to a staggering 145%. This isn't policy; it's economic brinkmanship without a plan, a tantrum disguised as bravado.

And he’s doing it at the worst possible moment.

One in three Americans has more credit card debt than savings. Two in three couldn’t survive a month without income. But instead of lowering costs, Trump is extorting the supply chains that keep prices stable—and daring working families to survive the fallout.

The result? Markets in freefall. Allies bewildered. Inflation primed to surge. And for what? To chase a foredoomed fantasy—that tariffs can turn back the clock, rebuild a hollowed-out manufacturing base, and frighten adversaries into submission.

What comes next isn’t a revival—it’s inflation, broken alliances, and a Fed forced to choose between recession and long-term stagflation.

This isn’t America First.

It’s America Last, on fire, and cheering for the match.

Trump and his supporters framed sweeping tariffs as a tough but necessary response to decades of globalization that have hollowed out U.S. industry, bled away middle-class jobs, and left entire towns on life support.

But the past week has made it painfully clear: tariffs aren’t a reset—they’re a retreat, and the administration’s own actions have exposed just how insincere and self-defeating that retreat really is.

From the outset, the White House cast its tariffs as an uncompromising response to what officials called a “national emergency”, explicitly declaring it “not a negotiation." Trade adviser Peter Navarro hammered the point in a Financial Times op-ed, insisting this was a long-overdue reckoning with a “rigged system”, not a ploy. Commerce Secretary Howard Lutnick vowed there was “no chance that President Trump’s going to back off”, while Treasury Secretary Scott Bessent flatly rejected talks, telling NBC News “No. No, no, no” when asked about potential negotiations.

But this show of unity quickly unraveled. As markets plunged, over $6 trillion in value was wiped out—the S&P 500 fell 12%, Japan’s Nikkei 6%, and Europe’s SX5E fell 8%.

While Navarro clung to tariff purity, Bessent—alarmed by spiking bond yields and mass liquidation—scrambled to put out the fire Trump had started, reportedly flying to Florida to convince the President that crashing the global economy wasn’t a viable strategy.

This internal fracture burst into public view with all the subtlety of a circus brawl when Elon Musk openly contradicted the White House, advocating for free trade and 0% tariffs—prompting Navarro to question Musk’s patriotism and Musk to fire back, calling the trade adviser “Peter Retarrdo” on social media, a spat Press Secretary Karoline Leavitt awkwardly dismissed as “boys will be boys.”

Secretary of Housing and Urban Development Scott Turner leads a prayer at

the first cabinet meeting of Trump’s second term [Brian Snyder/Reuters]

Secretary of Housing and Urban Development Scott Turner leads a prayer at

the first cabinet meeting of Trump’s second term [Brian Snyder/Reuters]

Instead of strength, chaos took hold. As economic panic set in and criticism from Wall Street and business leaders intensified, Trump abruptly changed course—pausing most new tariffs for allies and signaling an immediate willingness to negotiate, even as he enforced the 10% universal tariffs and escalated tariffs on China to 145%.

The administration scrambled to reframe this retreat as a masterstroke—claiming “maximum negotiating leverage” and boasting that “dozens of countries rushed to talk.” But the spin unraveled instantly: as former Trump aide Marc Short put it, “It appears as if they’re in retreat." The market’s brief rally evaporated, and stocks resumed their slide as uncertainty and the escalating trade war with China kept recession and bear market fears front and center.

No CEO will invest billions in new U.S. production if trade policy changes on a whim. Instead of “reshoring,” companies reroute supply chains or automate away jobs. Even if a few plants do reopen, they’ll be heavily automated by robots, not legions of high-paid assembly workers. All tariffs accomplish is to raise consumer prices and wreck business confidence—neither of which puts the middle class back on solid ground.

On national security, the tariff-first approach is just as misguided. If China is the real threat, why lash out at our closest allies? Blanket duties treat Germany and Japan the same as China—driving them away and nudging them closer to Beijing. That’s not strategy; it’s handing adversaries exactly what they want: an isolated America without strong partners to counterbalance them.

Some defenders argue that the U.S. consumer market is so big, other nations will eventually cave. They ignore a brutal truth. Rivals don’t have to outlast us—they can pivot to China. Beijing, with its vast resources and authoritarian stability, is already deepening ties in Europe, Africa, and Southeast Asia, building alternative trade networks that exclude American influence.

Worse yet is the cynical notion that tariff-fueled market turmoil might lower interest rates (they haven't), saving the government billions on its massive debt load. But Trump himself undercuts that claim: if the debt is priority number one, why push tax cuts that would add $4.5 trillion over the next decade—over ten times the potential interest-rate savings? Even taken at face value, using Americans’ home values, retirement accounts, and purchasing power as collateral for government debt relief is anti-American and a betrayal of so-called conservative values.

At its core, the pro-tariff stance boils down to a grim verdict on American capability:

“We can’t keep up, so let’s pull the ripcord.”

But the past week has shown that even this defeatist logic can’t survive contact with reality. When policy is made by impulse and reversed by panic, the world stops taking us seriously—and the costs, for all of us, are incalculable.

Tariffs raise the cost of everything we buy—and also cripple the exports we sell, since retaliations hammer America’s trade-reliant sectors (roughly a quarter of our stock market). For everyday Americans, tariffs act as a stealth tax, with families projected to pay on average an extra $3,800 a year in higher costs, according to the Yale Budget Lab. Manufacturers like Stellantis are already shuttering factories and laying off workers, while American farmers face a 125% import duty from China, soon rising to 150% on key commodities like soybeans—far worse than the devastating 2018 trade conflict that already cost them $26 billion in lost exports.

By undermining global trust in the dollar and U.S. markets—where foreign investors currently hold $23–27 trillion in assets—Trump’s trade war takes a direct shot at America’s premier strategic advantage as the global reserve currency. Before Trump reversed course, French President Macron had urged Europe to pull back investment from the U.S., raising the specter of a capital exodus that slashes stock values, hikes borrowing costs, and cripples America’s global influence.

And it all pushes the Federal Reserve to an impossible choice: tolerate inflation fueled by tariffs, or slam the brakes and risk stagflation. Either route punishes American workers—and neither makes us more secure.

This isn’t hardball diplomacy—it’s self-immolation disguised as brinkmanship, the kind of gutless volatility that signals to adversaries we’re a target, not a threat. The only thing Trump’s tariffs have truly accomplished is to prove, in real time, that chaos is the enemy of progress—and that America’s greatest vulnerability is not foreign competition, but our own schizophrenic leadership.

History is littered with cautionary tales of protectionist blunders—but rarely has a U.S. administration so quickly abandoned its own rationale, compounding the damage with chaos and confusion. If Trump’s tariff farce feels unprecedented, it’s because it is: never before has America lurched so violently from hardline threats to panicked retreat, all while torching its own credibility on the world stage.

But the underlying playbook—walling ourselves off from the world—has been tried before, and every time, it ended in disaster.

Yes, there were moments of industrial boom under high tariffs, but they invariably came tangled with soaring prices, stalled innovation, and economic pain that far outweighed any fleeting gains.

Take the so-called “McKinley model”—a favorite talking point of Trump’s economic nationalists. They point to the 40% average tariff of the 1890s and say: “Look, that’s how we built factories and grew rich." What they don’t tell you is that America’s real engine of growth back then was internal expansion: railroads that opened the West, massive waves of immigration that supercharged labor supply, and breakthroughs like electrification and telecom that had nothing to do with tariffs.

And they conveniently skip the fact that these same McKinley-era tariffs jacked up prices, triggered massive political backlash, and helped wipe out the Republican House majority in 1890. Tariffs may have raised a few factory walls—but they also burned household budgets and stifled competition, allowing bloated monopolies to grow fat and lazy behind protectionist barriers.

Yet even McKinley’s crude protectionism pales in comparison to what came four decades later.

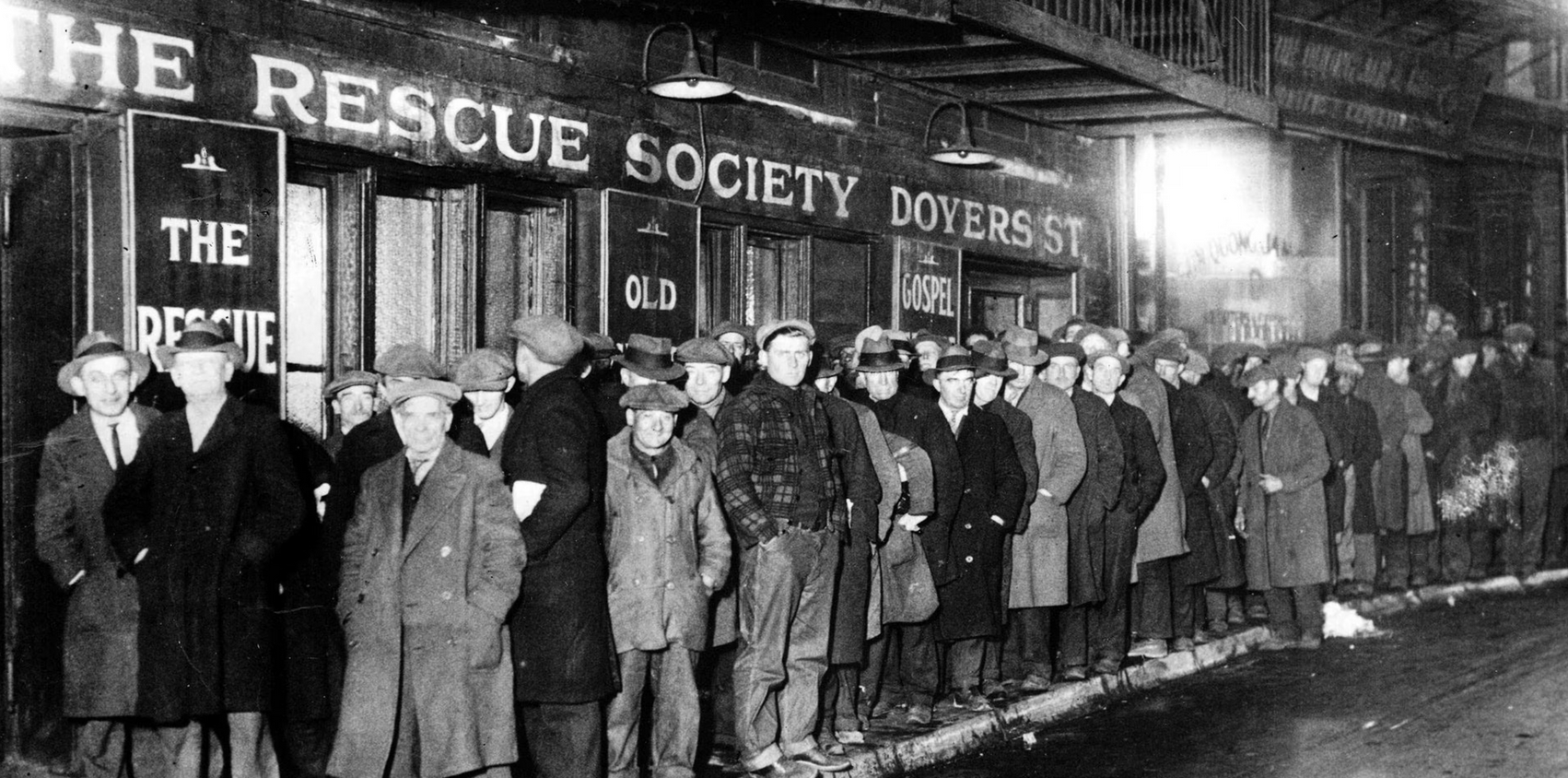

The Smoot-Hawley Tariff Act of 1930 wasn’t just bad policy—it was economic arson. In the middle of a downturn, Congress decided to light a fire under consumer prices and global tensions by slapping tariffs on hundreds of goods. More than 1,000 economists begged them to stop. They didn’t. Within two years, over 20 countries retaliated, and global trade collapsed by 65%. U.S. exports tanked, farm surpluses piled up with nowhere to go, and the Great Depression got even deeper.

Smoot-Hawley became a textbook warning for a reason: it took a recession and made it a global implosion.

Men in a line for bread during the Great Depression - Rolls

Press/Popperfoto via Getty Images

Men in a line for bread during the Great Depression - Rolls

Press/Popperfoto via Getty Images

And Trump’s "plan"? It’s even worse.

Smoot-Hawley

targeted specific goods. Trump’s tariffs hit

everything, everywhere, all at once. Average tariffs will

skyrocket from 2% to over 25% (even after the

reversal)—the highest

since 1909. And unlike in the early 20th century, where most economies were still

relatively self-contained, today’s are

entirely entangled—meaning

every shock loops back to hit us twice as hard.

This isn’t strategy. It’s economic nihilism.

Worse, it torches the very order America built after World War II: a global system of open trade, stable currency regimes, and coordinated rules—a system that let the U.S. dominate global finance and innovation for 75 years. Trump isn’t just abandoning that legacy—he’s pissing on its grave.

Trump promises strength through retreat—selling fear as strategy, walls as solutions, trade wars as leverage, and tariffs as a path to prosperity.

But real strength isn’t forged in isolation. It’s built by investing in ourselves, leading with allies, and out-competing adversaries where it matters most.

Here’s the smarter path forward—not slogans, not stunts, but a blueprint for lasting power.

Trump wants to resurrect a factory economy from the 1950s. But America’s power in the 21st century won’t come from sewing T-shirts or welding steel. It will come from owning the future of technology, from chips to AI to clean energy.

That’s exactly what targeted industrial policy is already doing—without the collateral damage of tariffs. The CHIPS and Science Act is pouring $52 billion into semiconductor manufacturing, with over $400 billion in follow-on private investment. TSMC, Intel, and Samsung are building mega-fabs in Ohio, Arizona, and Texas.

The Inflation Reduction Act unleashed a clean energy arms race: $493 billion invested, 170,000+ jobs created, and over 270 new projects in solar, EVs, and battery production—all tied to “Made in America” incentives. That’s how you build a resilient, sovereign industrial base—by incentivizing innovation, not complacency.

Trump’s trade war treats every country like a threat—friend or foe. But America’s most powerful advantage is something China can’t buy: our network of alliances.

That’s how we secure critical supply chains without raising prices on American families. It’s called friend-shoring—sourcing vital materials and manufacturing from trusted partners.

This is the new economic NATO—not a wall, but a web. Isolation weakens us. Coordination multiplies our power.

Tariffs don’t rebuild the middle class—they tax it. They raise prices, kill jobs, and offer false promises of a manufacturing revival that never comes.

If we want to compete, we need to train, empower, and pay American workers like they matter.

Germany trains 1.5 million apprentices annually. The U.S.? Barely half a million. We need a national commitment to vocational excellence: apprenticeships, technical colleges, debt-free STEM pathways, and labor protections that reward skill, not just survival.

We don’t need to shield workers from competition—we need to give them the tools to win.

Trump’s trade war is a tantrum on the world stage. A real strategy doesn’t raise prices and alienate allies—it builds national capacity, deepens our alliances, and unleashes American talent.

Without parallel investments in innovation, skills, and alliances, Trump's indiscriminate tariffs don’t strengthen America—they set off a chain reaction of decline.

Within 14 hours of his “reciprocal” tariffs going into effect, Trump reversed course—but left a 10% blanket tariff in place and raised duties on China to 145%.

This instability undermines any potential argument for tariffs, leaving only the negatives.

First will come the price hikes and retaliatory tariffs, then the diplomatic fractures, as allies—bewildered by the chaos—begin to question America’s reliability. Instead of rallying them to confront China’s abuses, Trump’s volatility pushes them toward Beijing, which now positions itself as the calmer, more stable alternative.

And the deeper this spiral goes, the harder it becomes to climb out. As trust erodes, capital flees. As alliances weaken, norms collapse. The U.S. doesn’t gain economic independence—it gets left behind.

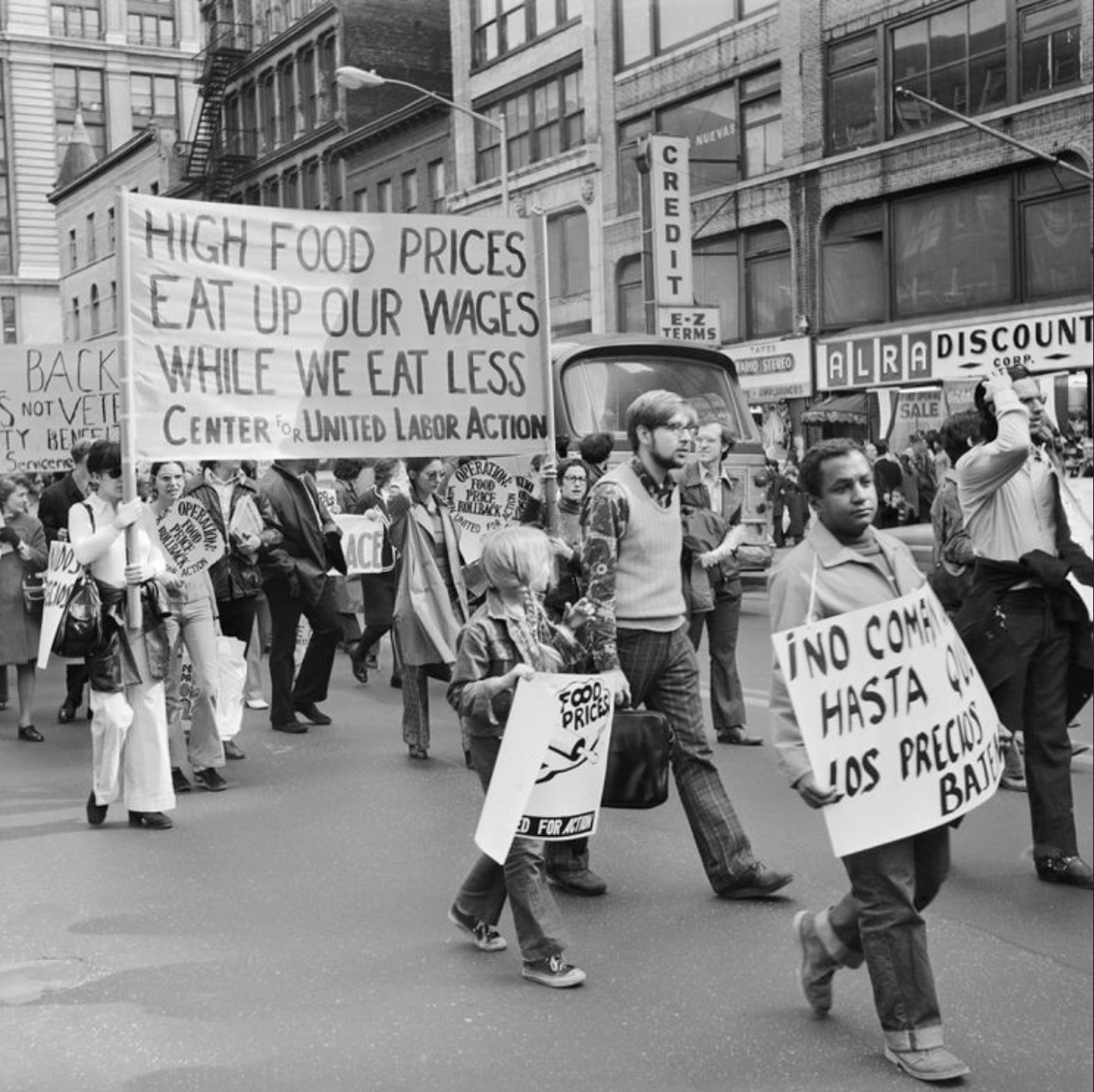

With the Fed caught between surging prices and slowing growth, we face the worst-case outcome: long-term stagflation.

Protests during the stagflation crisis of the 1970s - H. Armstrong

Roberts/ClassicStock / Getty Images

Protests during the stagflation crisis of the 1970s - H. Armstrong

Roberts/ClassicStock / Getty Images

We’ve seen this before. In the 1930s, nations turned inward, built walls, and sparked a global implosion. What followed wasn’t strength—it was devastation.

The grievances of globalization are real, but Trump's reckless reversals and astronomical tariffs on China aren't solutions—they're accelerants, fueling instability and economic chaos. The answer isn't retreat. It's reinvestment, reform, and relentless engagement.

True strength isn’t built by walling off the world. It’s forged by leading it.

And a nation that mistakes retreat for revival risks learning too late that the real cost of isolation isn’t just economic decline—it’s irrelevance.

Look to your left. Look to your right. One of us won't have the savings to weather what's coming.

One of us will lose a job.

One of us will lose a home.

And all of us—every single one of us—will pay the price.

So organize.

Protest.

Call your representatives.

And demand a government that serves its people, not the erratic impulses of one man.